Lei Yongjian and Paul Ranjard, 16 January 2025, first published by WTR

• Trademark filings in China dropped 24% between 2021 and 2023, driven by representation rule changes and higher success rates in oppositions and invalidations

• Trademark registrations have fallen at an even steeper rate, driven by the CNIPA’s increased application of absolute and relative grounds for refusal

• Practices that were introduced to target bad actors are having an unwitting effect on legitimate rights holders

China has witnessed a significant decline in trademark filings and registrations over the past few years. Declining trademark numbers between 2021 and 2023 have raised questions about the underlying causes and the ramifications for brand owners. Understanding these changes is crucial for businesses looking to navigate the country’s evolving trademark landscape.

What drove the initial surge in trademark applications

In 2006, China announced its National Strategy for the Development of Intellectual Property, which ushered in new rules facilitating and encouraging the filing of IP rights by accelerating procedures and lowering associated costs.

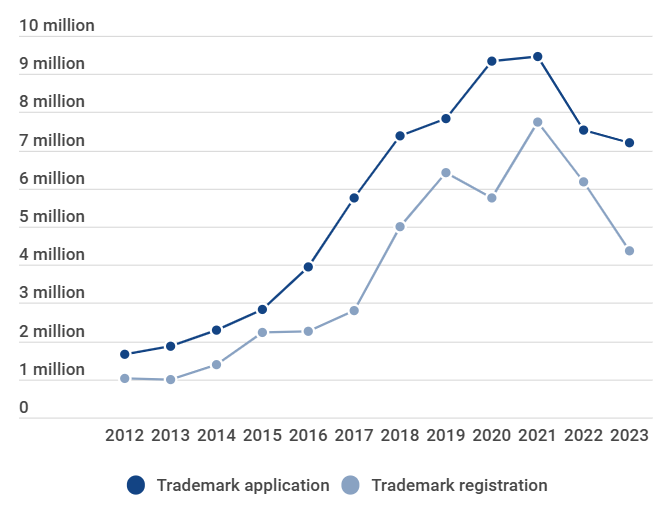

This strategy and the various derivative initiatives proposed by local governments to incentivise the application and creation of intellectual property turbocharged trademark filings. The annual number of trademark applications ballooned from around 1 million in the early years to a peak of 9.45 million in 2021.

However, it became progressively obvious that these numbers did not represent the normal course of business. Indeed, a large number of trademark applications were made by so-called ‘hoarders’, who were filing huge quantities of trademarks for the purpose of profiteering, without any intent to put these marks to genuine use.

Key factors behind the decline in applications

The number of trademark applications in China has declined rapidly since peaking in 2021.

The number of trademark filings dropped to 7.52 million in 2022, and again to 7.19 million in 2023 – on par with the 7.37 million filed in 2018.

There are various reasons for this.

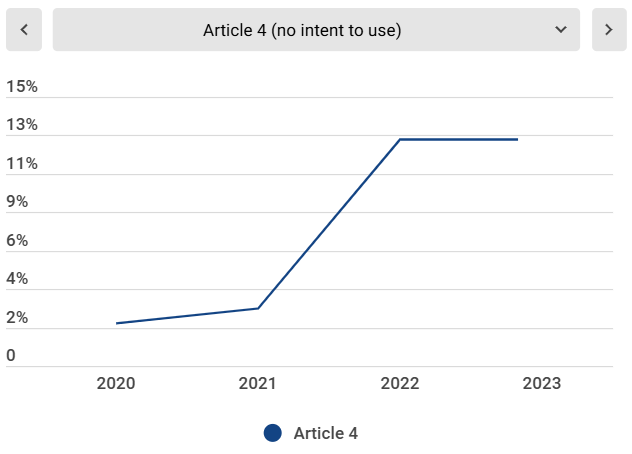

Revision of the Trademark Law

The increase in trademark activity triggered the fourth revision of the Trademark Law in 2019, when Article 4 was modified to address the act of “filing an application, in bad faith, without intention to use”. The lack of intent to use, combined with bad faith, became an absolute ground of refusal.

In addition, China introduced disciplinary measures to hold bad actors at trademark agencies accountable, and adopted a new approach to declutter the registry.

Stricter eligibility threshold for trademark agencies

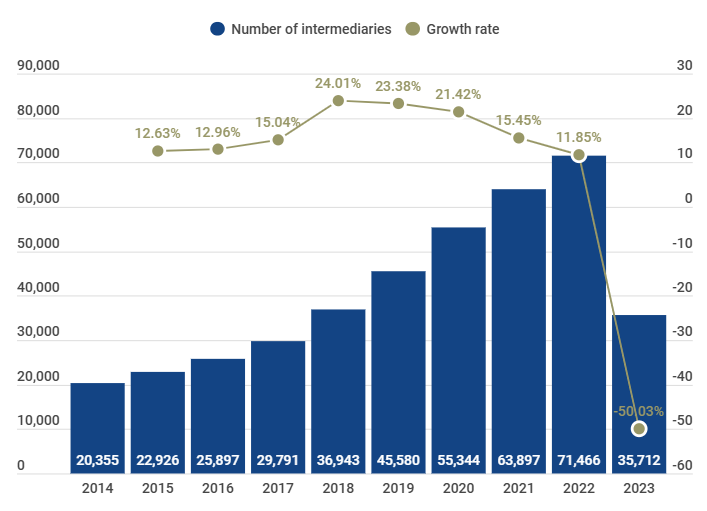

In 2023, the China National Intellectual Property Administration (CNIPA) mandated that all entities acting as an intermediary in trademark matters must undertake a re-registration process, during which their eligibility would be scrutinised and reassessed.

This move almost halved the number of players in the field, from some 71,000 trademark intermediaries to around 35,000. The CNIPA was believed to be leveraging the screening process to proactively weed out incompetent and unethical players.

Number of recorded trademark intermediaries in China – 2014-2023

Source: How China’s IP Agency Industry Fares in 2023, CNIPA

Higher success rates in opposition and invalidation cases

In the past couple of years, it has become easier to remove problematic trademark registrations.

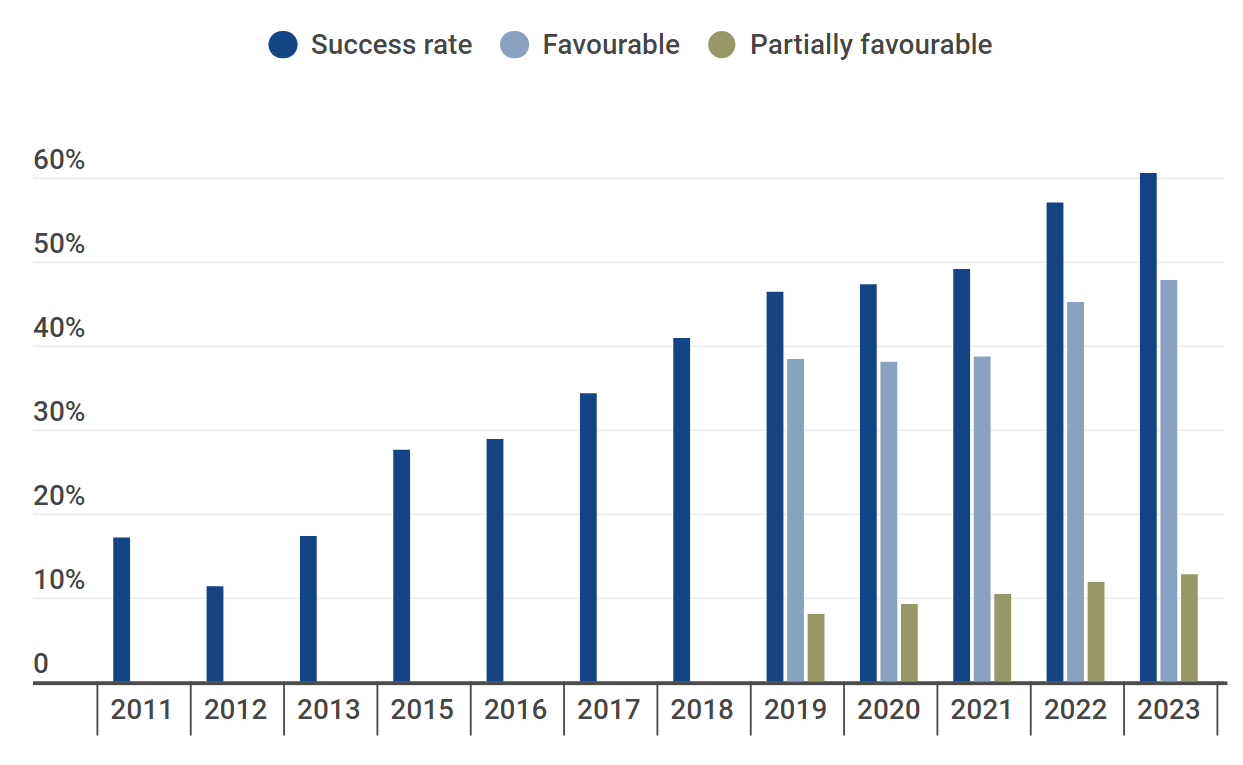

The success rate for opposition cases surged to over 60% in 2023, compared to a meager 17% in 2011. Meanwhile, invalidation and non-use cancellation cases see even higher success rates.

This shift has made it easier for genuine brand owners to challenge bad-faith filings, but it has also created a more challenging environment for new trademark applications.

For instance, the 60% success rate for opposition cases in 2023 can be broken down into:

• 48% refusal of the opposed goods and services in their entirety; and

• 12% partial refusal.

These refusals are attributed to the CNIPA’s greater emphasis on evidence of prior use, bad faith and other legal grounds in favour of genuine brand owners. The threshold for admitting relevant evidence has been significantly lowered to the benefit of the opposing party.

Success rates in opposition cases in China – 2011-2023

Source: data extracted from CNIPA’s annual white papers

Other changes

Additionally, it has become routine practice to suspend the review of a trademark application that has been refused on account of a prior mark, while the applicant of the refused trademark initiates the necessary proceedings to resolve the issue. It is therefore not necessary to keep filing back-up applications to secure earlier filing dates; the original application can remain in the queue, with its initial filing date, while the applicant awaits the results of other parallel proceedings.

All of these factors seem to have discouraged a substantial number of bad-faith filers.

Trademark registrations fall at even steeper rate

The decline in trademark filings and the clamp-down on problematic filings and registrations would naturally be expected to lead to a drop in trademark registrations.

This is what happened between 2021 and 2022, when the number of applications and registrations both tumbled by 20%. However, between 2022 and 2023, the number of trademark registrations dropped by a dramatic 29% (or 1.8 million registrations), while the number of applications only dipped 4% (or 330,000).

This indicates that the CNIPA has become more stringent in granting registrations.

Decline in trademark registrations compared to applications in China – 2012-2023

Source: data extracted from CNIPA’s annual white papers

The following trends have also been witnessed in practice.

Increased application of absolute grounds for refusal

The CNIPA has adopted stricter criteria for examining trademark applications, frequently citing absolute grounds for refusal. These include marks deemed to be:

• deceptive;

• descriptive;

• harmful to social morality; or

• not intended for use.

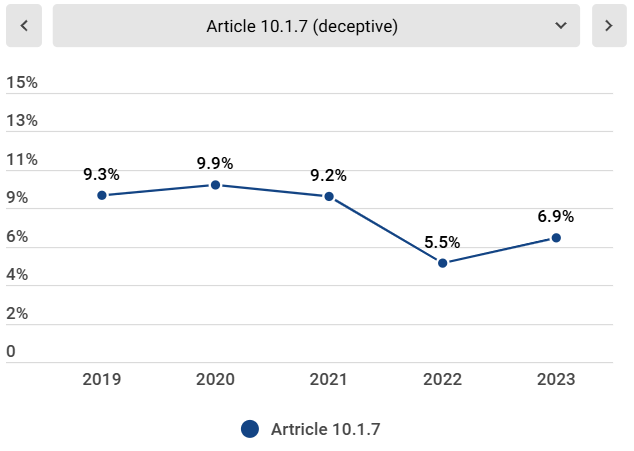

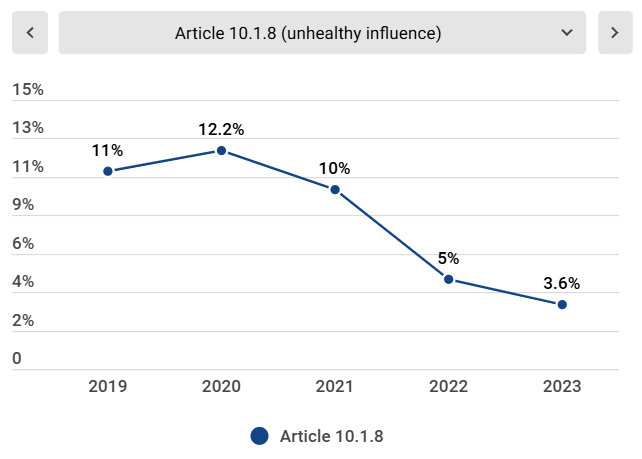

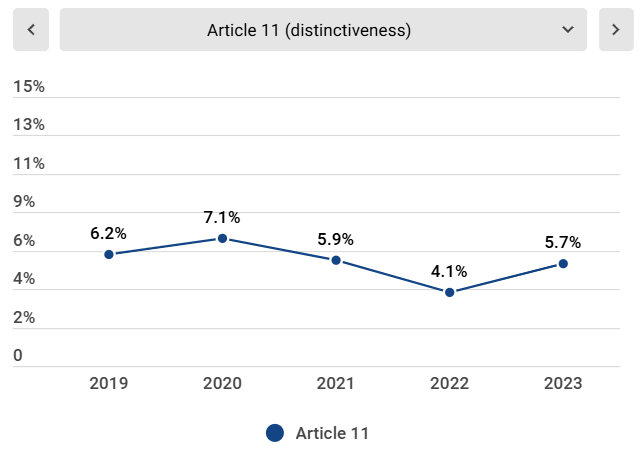

With the sheer number and proportion of decisions citing such grounds on the rise since 2020, applicants often stand a slim chance of overcoming a preliminary refusal based on these grounds. For example, the data below shows that, in 2023, if an application was refused due to unhealthy influence, the applicant had only a 3.6% likelihood of successfully convincing the examiner to reverse the refusal on appeal.

Success rates of overturning ex officio refusals citing Articles 4, 10.1.7, 10.1.8 or 11 (including partial approval)

Source: MOZLEN

Increased application of relative grounds for refusal

In addition, on the issue of relative grounds, the CNIPA has been adjusting its methodology in assessing similarity and is citing more prior marks to refuse junior applications.

This burdens new applicants, who need to engage in review proceedings while contesting the registrations of prior trademarks cited by the CNIPA.

How brand owners can adjust to the changing landscape

It is welcome news that the evolving trademark system is effectively targeting and dissuading bad-faith trademark applicants. However, good-faith trademark applicants are suffering as well.

Below are three practical takeaways for good-faith filers.

Stay informed

Keep abreast of the latest practices and guidelines from the CNIPA and the courts. For example, the 2023 Guidelines on Prohibited Trademark Usage introduced new rules that could impact both new and existing trademarks. Working closely with local counsel can provide valuable insights and help businesses to stay ahead of regulatory changes.

Leverage enforcement mechanisms

With higher success rates in opposition and invalidation cases, brand owners should be more aggressive in filing oppositions, invalidations and non-use cancellation actions. The good news is that such actions stand a better chance of success. Absolute grounds can be leveraged in these contentious proceedings to protect brand integrity. Some old bad-faith registrations can be removed under the current new practice around absolute grounds.

File strategically

Adopt a more strategic approach to trademark filings, focusing on quality over quantity. Ensure that applications are well prepared and meet the CNIPA’s stricter criteria to avoid unnecessary refusals.

For new brands, businesses should conduct thorough clearance searches and comprehensive risk assessments, particularly on absolute grounds, before filing new trademarks. This will help to avoid costly refusals and potential penalties when the mark is used before registration.

Companies with established brands and older trademarks should be cautious and strategic when refiling a new version of their mark. It is essential to ensure that the refiling is not rejected on certain absolute grounds, which may jeopardise existing registrations. (The CNIPA’s 2023 Guidelines on Prohibited Trademark Usage also introduced penalties for using such marks, adding another layer of risk for brand owners. For example, a trademark owner that secured a registration 20 years ago and has been using the mark since then might face refusal when refiling the same trademark in 2023 due to new absolute grounds. This refusal could theoretically be used by competitors to invalidate the older registration, leading to potential legal and PR issues.)

Brand owners in the fast-moving consumer goods industry sometimes launch seasonal products, which come with seasonal brands. Brand owners may opt to use such marks without filing trademark applications, if such practice poses little risk. This approach especially applies when:

• the seasonal brands are more or less descriptive; and

• there are other elements in the actual use that could substantially mitigate the use risk (eg, whether the potential challengers have used their marks, or there is room for arguing no confusion).

New restrictions are missing the target

It appears that the boom in trademark filings was the result of actions by those who view trademarks not as signs serving to distinguish their products or services from the competition, but as pure 'commodities' that could be traded for profit. This behaviour should have been the only target for policy change. There is no doubt that the measures taken in response – the amendment of Article 4 of the Trademark Law, improved governance of trademark agencies and stronger administrative procedures against bad-faith applications – have had, and will continue to have, a deterrent effect on these behaviours. These measures will continue to reduce the mass of trademarks on the register that have been filed for the wrong reasons and are unused.

However, the new restrictions imposed on all trademark applicants (eg, extensively referring to absolute grounds of refusal and, in particular, using the concept of deceptiveness rather than lack of distinctiveness) are missing the target. In fact, bad-faith trademark applicants do not care about such restrictions. Conversely, legitimate businesses that need these trademarks are more likely to bear the brunt of the side effects of these measures. It is therefore suggested that the authorities revert to implementing the law as it existed before the new practices were put in place in 2021 and 2022, particularly considering that bad-faith filing activities appear to have been effectively deterred in the past three years.